Last August, about 35 percent of home buyers identified themselves as first-time buyers. Flash-forward one year later, the share of buyers identifying themselves as first-timers has soared to 51 percent, according to research by realtor.com®.

As more first-time buyers re-emerge, new challenges – mostly financial – are becoming more paramount for the market, notes Jonathan Smoke, realtor.com®’s chief economist, in his latest column.

For example, about 9 percent of buyers are now reporting having difficulty qualifying for a mortgage, up from 5.6 percent a year ago. The number of buyers saying they need to improve their credit score has since doubled, increasing from 9.7 percent of all buyers in 2015 to 19.5 percent this August. What’s more, the percentage of buyers who say they don’t have enough funds for a down payment has increased from 16 percent a year ago to 25 percent this year.

“The market has seen growth despite higher prices in part because of pent-up demand from very qualified buyers who were able to meet the challenging mortgage qualifications that are the norm these days,” Smoke says. “A key question for the months ahead is whether a higher share of first-time buyers is ready or capable of qualifying for a loan and closing on a home.”

Smoke offers the following financial tips for first-time buyers who want to make a move sooner rather than later:

Get your finances in order: Know your FICO score and take efforts to get it above 700 to improve your chances of qualifying for financing and securing a better interest rate. Also, start collecting financial records, like recent bank and financial statements, the past two years of income tax filings, and pay stubs.

Know your down payment: The average down payment for 2016 is 11 percent nationwide. That can vary dramatically, however. Several down payment assistance programs also are available to help.

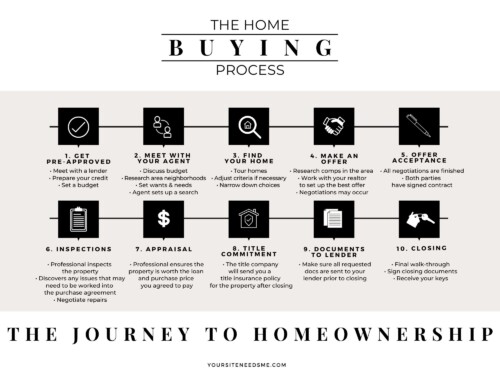

Get pre-approved: Getting pre-approved will prove you do have the finances in place to qualify for a mortgage and purchase a home. “A pre-approval letter as part of an offer will communicate to the seller that you have the ability to close,” Smoke notes.

Source: “First-Time Home Buyers Come Out in Force – But Face New Challenges,” realtor.com® (Sept. 8, 2016)